What is Spot Energy?

Here at Outlettick, we offer our clients trading on spot energy, such as Brent, WTI and Natural Gas, which are considered to be the most important raw material resources on the planet.

Review the assets above and discover the possibility of new trading opportunities in the financial market.

CFDs on energy are a popular choice for short-term trading, especially when there is a surge in energy consumption, as during periods of active growth, demand increases. Prices are determined by global supply and demand for the physical product.

Often referred to as “black gold”, Oil is usually denominated in U.S. Dollars (hence the term ‘Petrodollar’), so a weak dollar will commonly cause Oil prices to rise, as the price of the product is directly influenced by the value of the currency.

Oil-producing nations have a dramatic effect on the supply, and therefore the price, as they may withdraw or boost the physical quantity of barrels available in the market.

For example, since the mid-90s, the US imposed sanctions on Iran have prevented Iranian oil from entering the marketplace, widening the gap between supply and demand which results in higher prices. Another noteworthy event occurred in 2014 when a much lower demand from the EU and China caused a sharp decrease due to the excess supply. For many years, the US government has been building up its oil reserves and should these be released to the market, or used domestically, energy prices may drop sharply as a result.

In the case of NatGas, an alternative energy commodity to oil, historical analysis shows a general correlation between the two, considering that natural gas is often released during the oil drilling process, and they are commonly produced by the same companies or nations.

In conclusion, a multitude of economic factors can affect the price of energy, including inflation rates, political or military tensions in producing nations, natural disasters, production costs and of course, OPEC decisions.

Trading CFDs on energy allows you to speculate on price movement, without having to physically acquire the underlying asset. As prices fluctuate, traders make profit or loss depending on their position and direction in the market.

Trade FX majors, minors, and exotics

with ultra-tight spreads and flexible leverage.

Access your earnings

with no unnecessary delays.

Why trade forex market with Outlettick

- Stop Out Protection

- Low and stable spreads

- Fast execution

- Decision assistance

Stop Out Protection

Trade Forex online with a unique market protection feature that shields your positions against temporary market volatility and delays or avoids stop outs.

Low and stable spreads

Trade the forex market with low and predictable trading costs. Enjoy tight spreads that stay stable, even during economic news releases and market events.¹

Fast execution

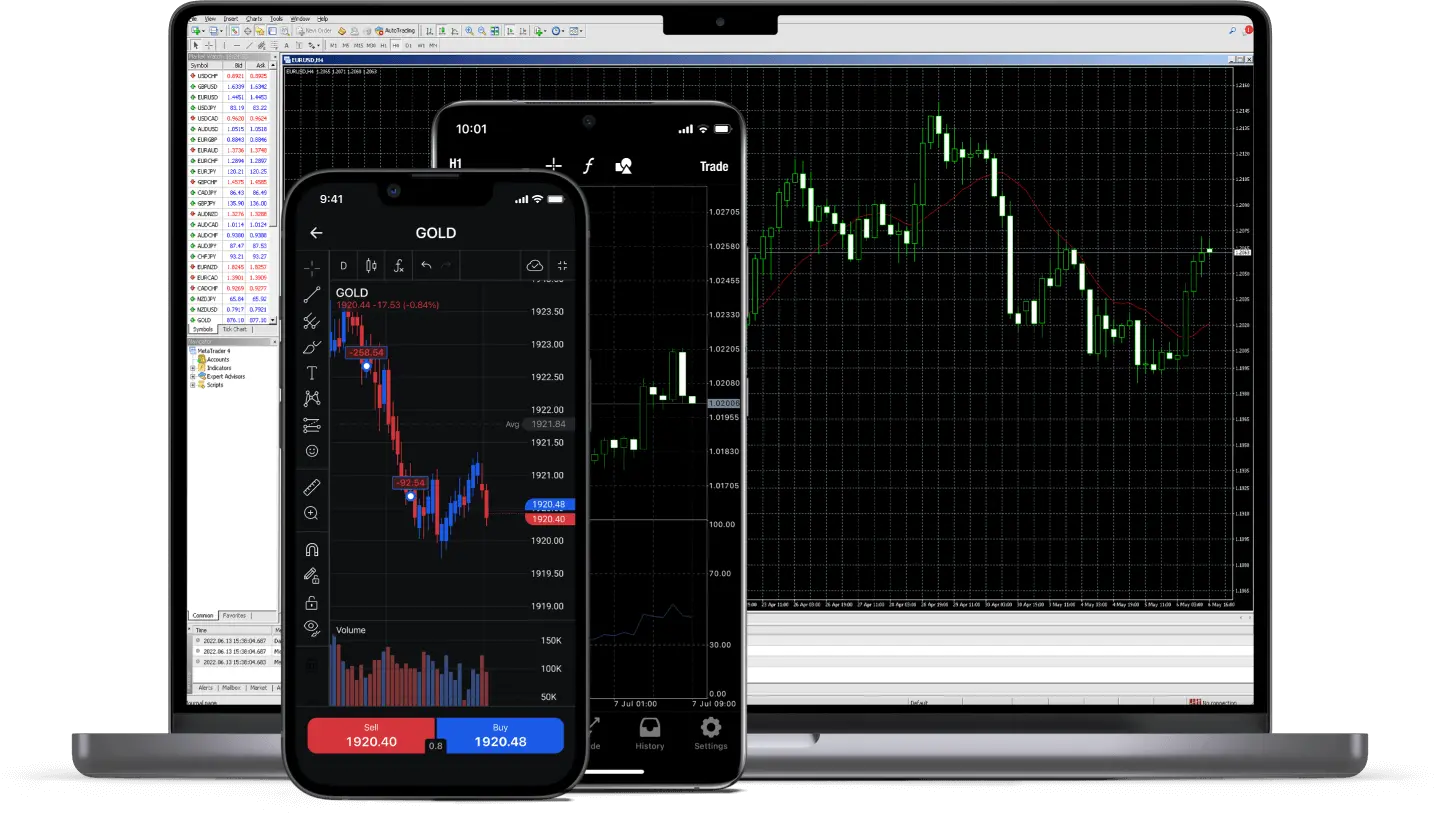

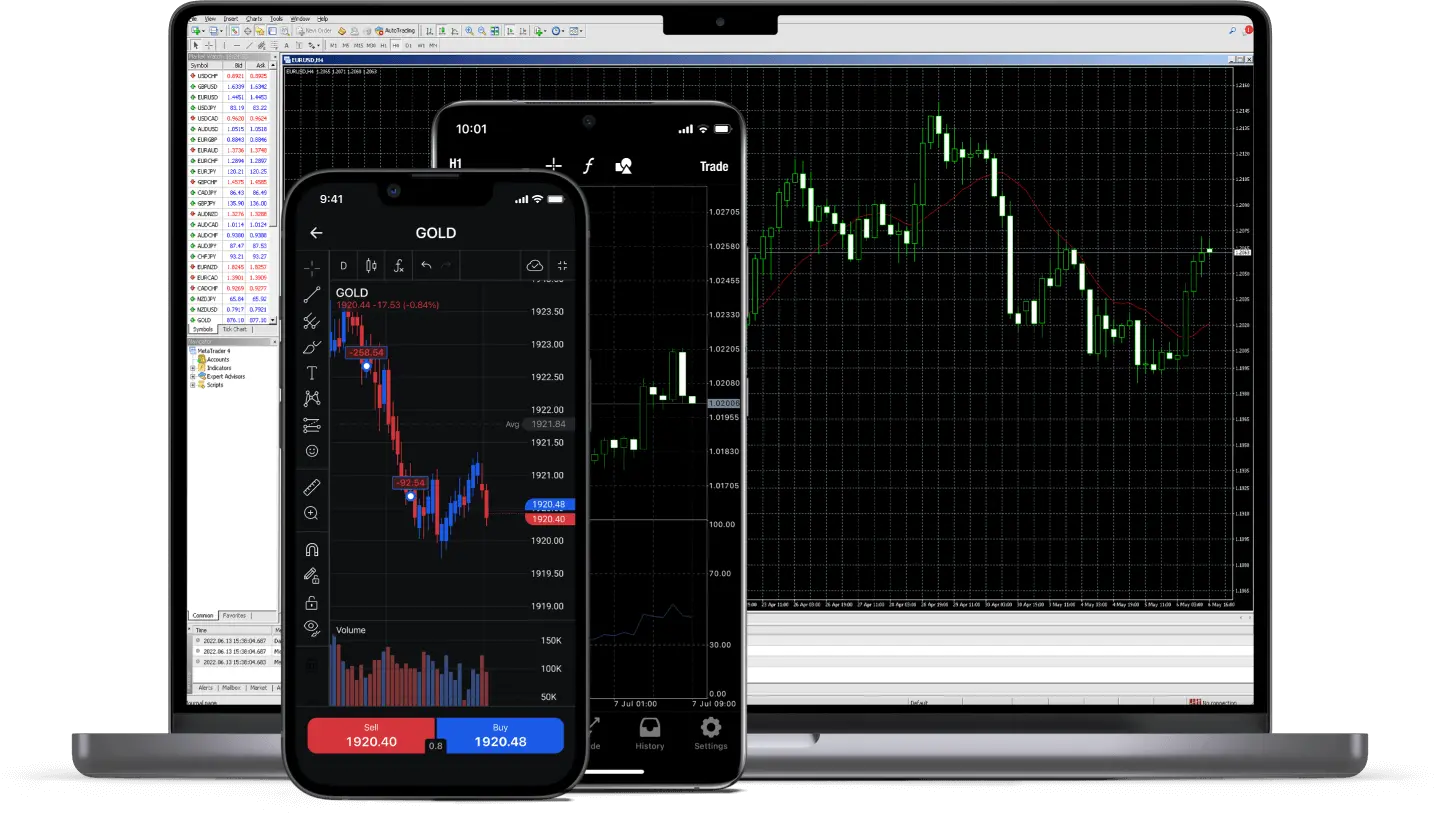

Capitalize on the frequent price movements of popular currency pairs with ultra-fast execution. Get your FX trading orders executed in milliseconds on all available terminals.

Decision Assistance

Experience efficient trade execution management, decision support, and real-time market data.

WebTrader

Trade seamlessly on your browser, blending functionality and flexibility for trading on any device.

Stable & secure servers

Our servers are designed to handle the highest trading volumes, so you can trade with confidence.