What Are Indices?

World indices are indicators of price changes for a certain group of securities. The stock exchange index can be explained as a “basket” of shares united by a common basis. Trading indices can be compared to opening positions on the courses of several dozen stocks at once.

The most important thing is determining the exact stocks or bonds each index is formed from. The set of shares included in the spot index value calculation determines the information that can be obtained by observing the dynamics of its course.

In general, the main purpose of world indices is to create a powerful indicator for investors to characterise the direction of companies’ quotes in a particular industry. Studying the dynamics of major indices helps to understand the impact of certain events on the value of securities.

During trading indices, keep in mind that the reaction to the economic news published may not correspond with expectations and forecasts.

For example, if there is a rise in oil prices, it is logical to expect an increase in the shares of all the oil companies.

However, different stocks grow at different speeds, while some of them may not respond to such news at all. In this case, the spot index helps traders to understand the overall trend of this market segment without the need to assess the position of lots of different companies.

Observation and trading indices give insights into how the different sectors of the economy trade in comparison with each other. Here at FxPro we are glad to offer the trading of CFD on major indices, which makes it possible to join the price movement not only for a rise, but also a fall.

Trading indices is popular among FxPro traders due to its comprehensive terms, accurate quotes from several suppliers and versatile analytics. After all, in order to understand the logic of the index behaviour, you need to pay attention to the corporate news of each of the companies included, as well as on events affecting the wider industry as a whole.

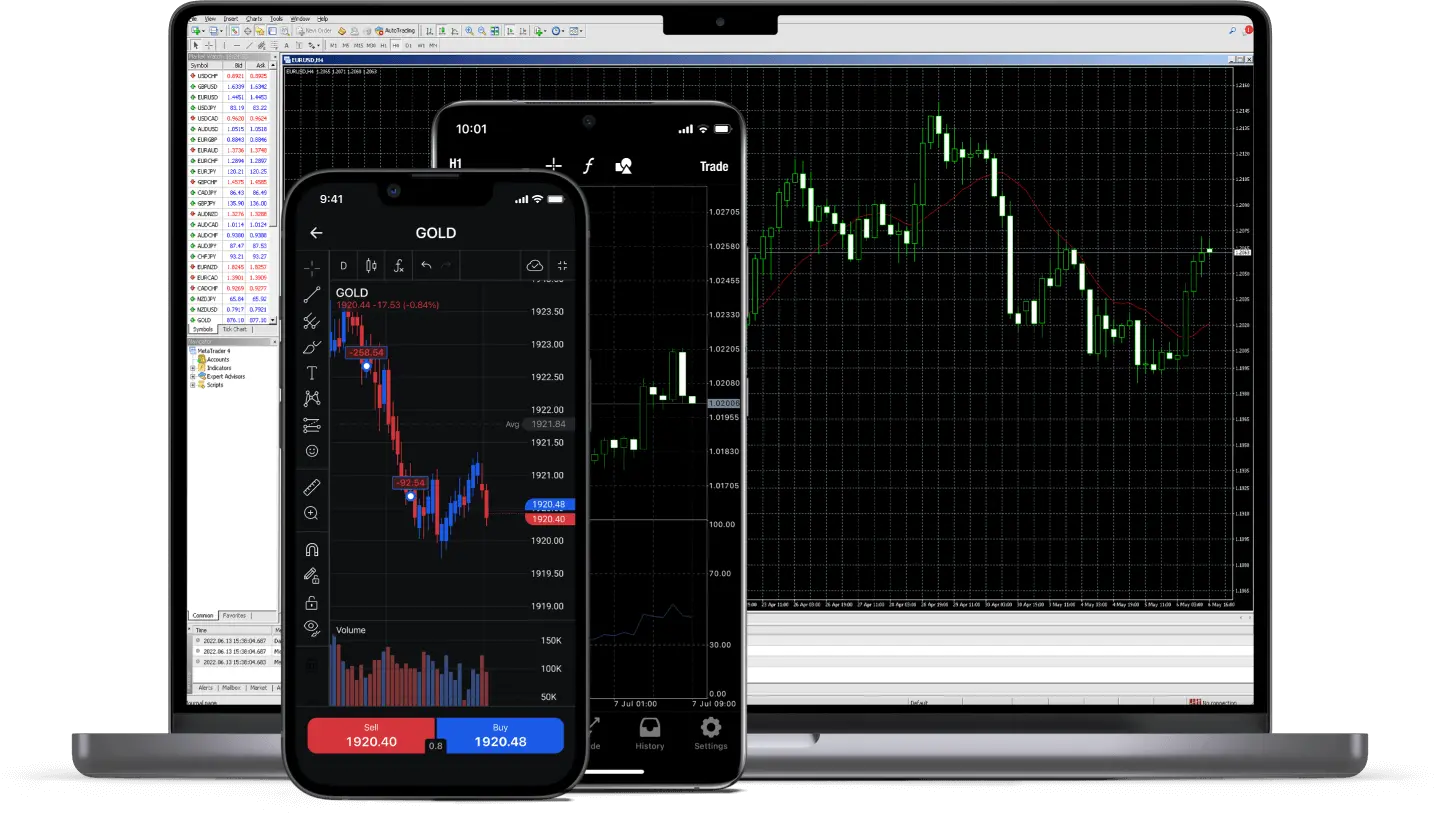

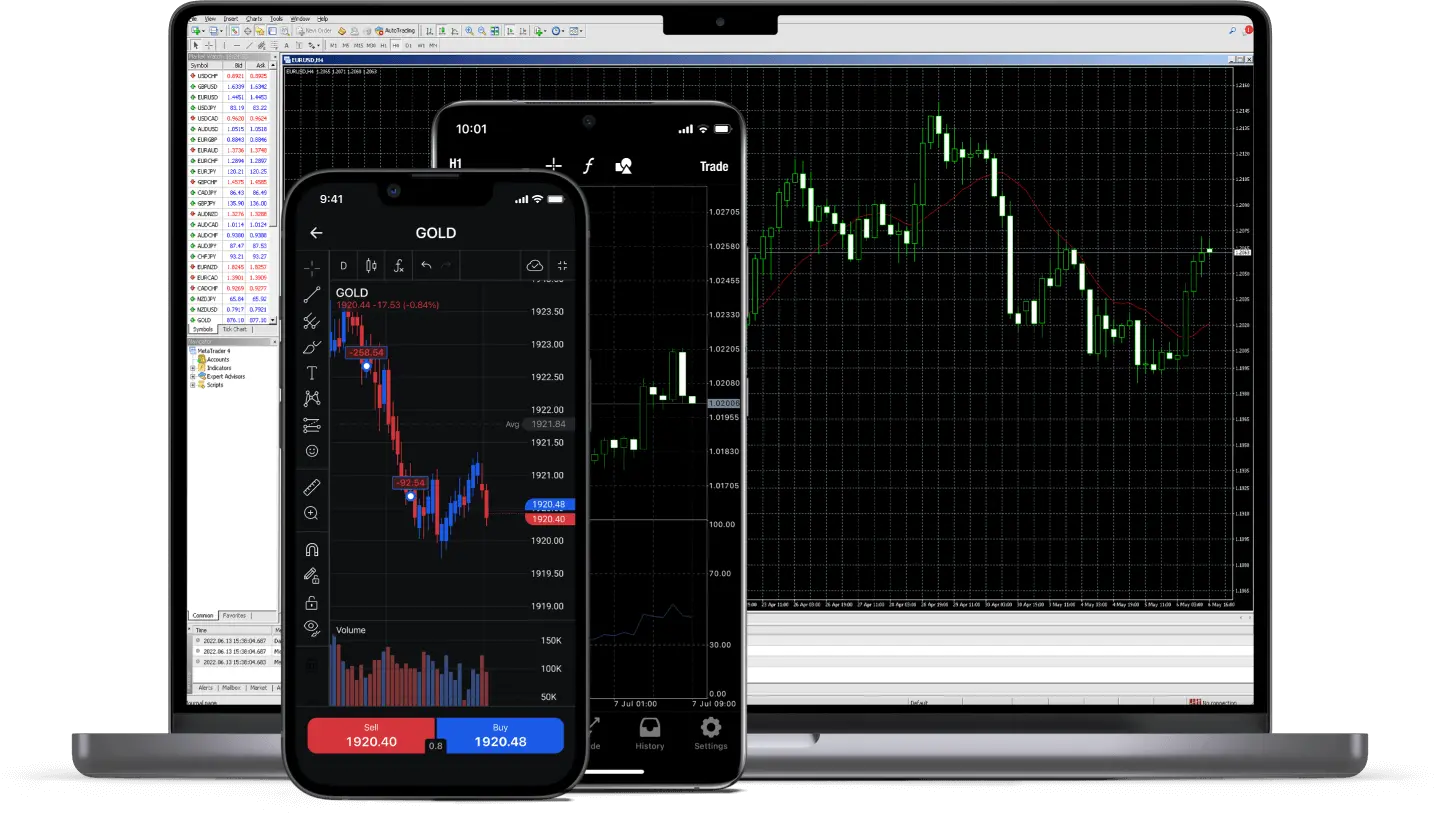

Trade FX majors, minors, and exotics

with ultra-tight spreads and flexible leverage.

Access your earnings

with no unnecessary delays.

Why trade forex market with Outlettick

- Stop Out Protection

- Low and stable spreads

- Fast execution

- Decision assistance

Stop Out Protection

Trade Forex online with a unique market protection feature that shields your positions against temporary market volatility and delays or avoids stop outs.

Low and stable spreads

Trade the forex market with low and predictable trading costs. Enjoy tight spreads that stay stable, even during economic news releases and market events.¹

Fast execution

Capitalize on the frequent price movements of popular currency pairs with ultra-fast execution. Get your FX trading orders executed in milliseconds on all available terminals.

Decision Assistance

Experience efficient trade execution management, decision support, and real-time market data.

WebTrader

Trade seamlessly on your browser, blending functionality and flexibility for trading on any device.

Stable & secure servers

Our servers are designed to handle the highest trading volumes, so you can trade with confidence.